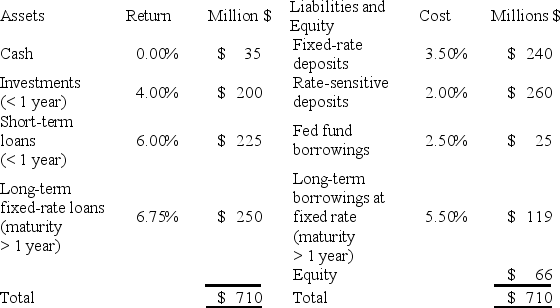

A bank has the following balance sheet:

If the spread effect is zero and all interest rates decline 50 basis points,the bank's NII will change by ________ over the year.

A) $0

B) $400,000

C) −$400,000

D) $700,000

E) −$700,000

Correct Answer:

Verified

Q34: For large interest rate declines,duration _ the

Q35: A bank has the following balance sheet:

Q36: A bank is facing a forecast of

Q37: A bank has a negative duration gap.

Q38: Weaknesses of the repricing model include the

Q40: With a six-month maturity bucket,a nine-month fixed-rate

Q41: What are four major weaknesses of the

Q42: Weaknesses of the duration gap immunization model

Q43: A bank has book value of assets

Q44: What factors can cause a bank's book

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents