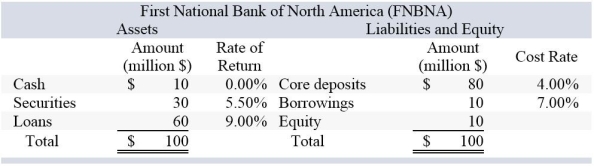

If FNBNA is expecting a $10 million net deposit drain and the securities liquidity index is 0.97,by how much will pretax net income change if the drain is funded entirely through securities sales?

If FNBNA is expecting a $10 million net deposit drain and the securities liquidity index is 0.97,by how much will pretax net income change if the drain is funded entirely through securities sales?

A) −$306,122

B) −$150,000

C) −$375,339

D) −$476,289

E) −$474,490

Correct Answer:

Verified

Q34: An increasingly positive financing gap can indicate

Q35: Q36: Which of the following results in a Q37: A financial intermediary has two assets in Q38: Bank A has a loan-to-deposit ratio of Q40: Which one of the following situations creates Q41: Does a positive or a negative financing Q42: Explain the relationship between each of the Q43: Explain how liquidity risk can lead to Q44: Which of the following statements,if any,is (are)true?![]()

I.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents