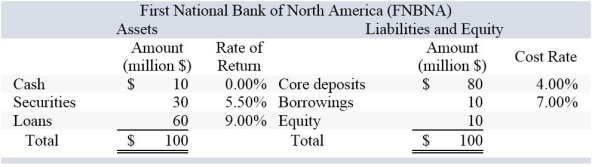

If FNBNA is expecting a $15 million net deposit drain and the securities liquidity index is 0.98,how many securities would have to be liquidated if the bank used only its securities to fund the expected deposit drain?

If FNBNA is expecting a $15 million net deposit drain and the securities liquidity index is 0.98,how many securities would have to be liquidated if the bank used only its securities to fund the expected deposit drain?

A) $15,000,000

B) $16,444,331

C) $15,600,000

D) $15,306,122

E) $16,772,345

Correct Answer:

Verified

Q16: Life insurers and property and casualty insurers

Q17: Property and casualty insurers have a greater

Q18: Relying on purchased liquidity is more risky

Q19: If a bank's brokered deposits increase $3

Q20: A widely accepted method measuring liquidity risk

Q22: Core deposits include all but which of

Q23: BIS' Basel Committee on Banking Supervision provides

Q24: A married couple each has an IRA

Q25: Insurance industry guarantee funds do not eliminate

Q26: Which one of the following is a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents