Multiple Choice

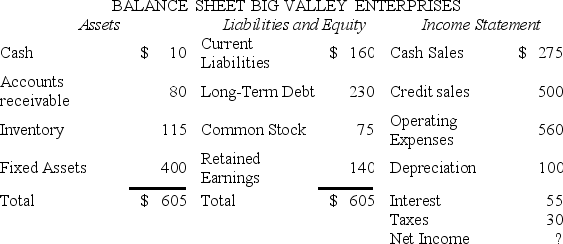

Interest is Big Valley's only fixed cash charge.

Big Valley's market value of equity to book value of debt ratio = 1.5.

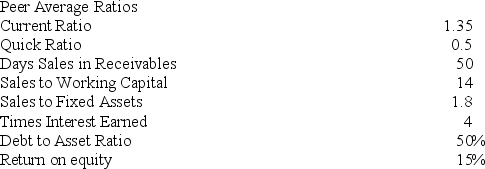

Big Valley's use of debt to finance assets indicates that Big Valley has ________ the typical firm in the industry.

A) more long-term solvency risk than

B) the same long-term solvency risk as

C) less interest expense than

D) less long-term solvency risk than

E) a lower market value of equity to book value of equity ratio than

Correct Answer:

Verified

Related Questions

Q18: As long as overall cash flow growth

Q19: A rising sales to working capital ratio

Q20: Residential mortgage loan applications have the most

Q21: Which one of the following five Cs