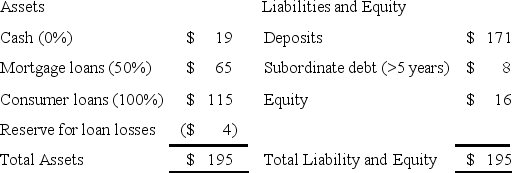

A Bank has the following balance sheet (in millions),with the risk weights in parentheses.

In addition,the bank has $30 million in commercial direct-credit substitute standby letters of credit to a public corporation and $30 million in 10-year FX forward contracts that are in the money by $2 million.

A) What are the risk-adjusted on-balance-sheet assets of the bank as defined under the Basel III?

B) What are the common equity Tier I (CET1)risk-based capital ratio,Tier I risk-based capital ratio,and the total risk-based capital ratio?

C) Disregarding the capital conservation buffer,does the bank have sufficient capital to meet the Basel requirements?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q50: The average daily net transaction accounts of

Q51: Which act allowed the establishment of full-service

Q52: Tier II (supplementary)capital includes which of the

Q53: The average daily net transaction accounts of

Q54: What changes to foreign bank operations in

Q56: How do risk-based deposit insurance premiums and

Q57: Among other things,the _ prohibits U.S. banks

Q58: (a)A bank has risk-weighted assets of $175

Q59: In the United States,regulators currently use a

Q60: The _ introduced the prompt corrective action

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents