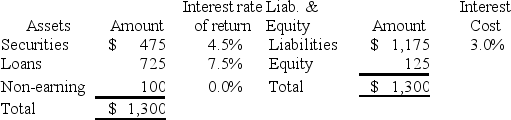

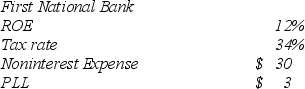

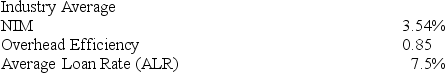

If the net noninterest income were to increase to −$16,what would the average loan rate (ALR)have to be to generate a 12 percent ROE? Compared to the industry,does this ALR appear feasible? If not,what options does FNB have?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q40: A bank has interest income to total

Q41: A bank can raise capital by:

A)Offering long-term

Q42: Investment securities plus _ is equal to

Q43: How has the negotiable feature of wholesale

Q44: Which of the following assets are used

Q46: What are the differences between purchased funds

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents