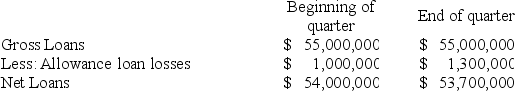

At the start of the quarter a bank has $55 million (gross)in its loan portfolio,and has $1 million in its allowance for loan loss account. During the quarter,loan audits indicate that an additional $300,000 of loans will not be paid as promised. These loans have not yet been written off as uncollectible,however. What are the starting and ending gross and net loan amounts and the provision for loan loss account,and what is the effect on the bank's quarterly earnings?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q49: Q50: A(n)_ is a contra asset account. Q51: Net loans and leases plus _ plus Q52: The AU ratio measures the bank's ability Q53: What is the difference between net charge-offs Q55: Which of the following is not an Q56: The largest market available for purchased funds Q57: All but which one of the following Q58: What are the major sources of purchased Q59: What is the largest operating expense for![]()

A)loan commitment

B)provision

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents