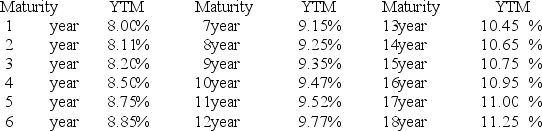

YIELD CURVE FOR ZERO COUPON BONDS RATED AA

Assume that there are no liquidity premiums.

To the nearest basis point,what is the expected interest rate on a four-year maturity AA zero coupon bond purchased six years from today?

A) 10.41 percent

B) 10.05 percent

C) 9.16 percent

D) 10.56 percent

E) 9.96 percent

Correct Answer:

Verified

Q16: When the quantity of a financial security

Q17: We expect liquidity premiums to move inversely

Q18: The term structure of interest rates is

Q19: If you earn 0.5 percent a month

Q20: Convertible bonds will normally have lower promised

Q22: An investment pays $400 in one year,X

Q23: An annuity and an annuity due with

Q24: Upon graduating from college this year,you expect

Q25: As the liquidity of corporate bonds decrease,the

Q26: You go to the Wall Street Journal

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents