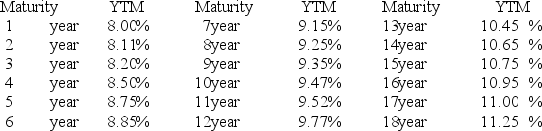

YIELD CURVE FOR ZERO COUPON BONDS RATED AA

Assume that there are no liquidity premiums.

You just bought a 15-year maturity Xerox corporate bond rated AA with a 0 percent coupon. You expect to sell the bond in eight years. Find the expected interest rate at the time of sale (watch out for rounding error) .

A) 13.92 percent

B) 11.00 percent

C) 8.85 percent

D) 12.49 percent

E) 12.80 percent

Correct Answer:

Verified

Q27: Classify each of the following in terms

Q28: You buy a car for $38,000. You

Q29: Investment A pays 8 percent simple interest

Q30: Suppose you can save $2,000 per year

Q31: A higher level of wealth causes the

Q33: According to the liquidity premium theory,investors preferring

Q34: An increase in interest rates increases the

Q35: An investor wants to be able to

Q36: Classify each of the following in terms

Q37: You want to have $5 million when

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents