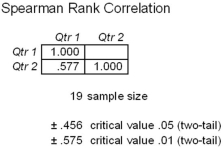

Returns on an investor's stock portfolio (n = 19 stocks) are compared for the same stock in each of two consecutive quarters.Since the returns are not normally distributed (normality test p-values were .005 and .126 respectively) ,a nonparametric test was chosen.The test results are shown below.  Which is the best conclusion?

Which is the best conclusion?

A) The returns are correlated neither at α = .05 nor at α = .01.

B) The returns are correlated at α = .05 but not at α = .01.

C) The returns are correlated at α = .01 but not at α = .05.

D) The returns are correlated both at α = .05 and at α = .01.

Correct Answer:

Verified

Q64: Which nonparametric test is analogous to a

Q65: Delta Air Lines wants to determine if

Q66: Which is a nonparametric test for runs

Q68: At the Food Barn, children can order

Q69: If there are three or more populations

Q71: Which is not a characteristic of the

Q72: Returns on an investor's stock portfolio (n

Q74: Which is not a characteristic of the

Q79: Which nonparametric test is used to test

Q80: Which nonparametric test is used to detect

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents