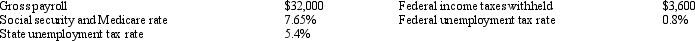

Use this information to answer the following question. Panadora Company has the following information for the pay period of January 1-15,2014.Payment occurs on January 20. Payroll Taxes and Benefits Expense would be recorded for

Payroll Taxes and Benefits Expense would be recorded for

A) $1,984.

B) $2,248.

C) $4,432.

D) $8,032.

Correct Answer:

Verified

Q101: When accounting for property taxes,which of the

Q112: Which of the following most likely is

Q114: Use this information to answer the following

Q117: Recording estimated product warranty expense in the

Q121: Lease agreements are

A)estimates.

B)commitments.

C)liabilities.

D)contingencies.

Q128: Liabilities that might arise from which of

Q136: Which of the following is an example

Q137: A contingent liability is best described as

Q138: Which of the following is a contingent

Q140: A customer is injured using a company's

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents