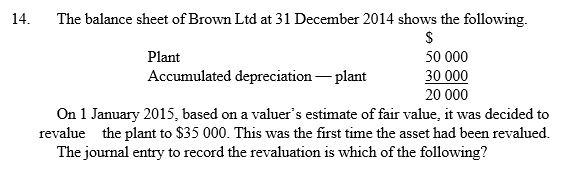

A) Accumulated depreciation - plant 30 000 Plant 15 000

Gain on revaluation plant 15 000

B) Plant 15 000 Gain on revaluation plant 15 000

C) Expense on revaluation of plant 15 000 Plant 15 000

D) Plant 15 000 Expense on revaluation of plant 15 000

Accumulated depreciation - plant 30 000

Correct Answer:

Verified

Q12: Which is the true statement?

A) A revaluation

Q13: Under IAS 36/AASB 136 Impairment of

Q14: Q15: Which statement concerning revaluations that reverse prior Q16: The carrying amount of a depreciable, non-current Q18: The basic accounting entry for a revaluation Q19: Which statement relating to revaluations of non-current Q20: A revaluation surplus is what type of Q21: Which statement relating to the composite-rate depreciation Q22: Midlothian Ltd uses composite-rate depreciation rate at![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents