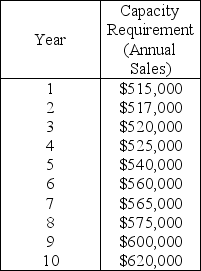

Sleep Tight Motel has the opportunity to purchase an adjacent plot of land.Building on this land would increase their capacity from the current sales level of $515,000/year to $600,000/year.Sleep Tight experiences a 20 percent before-tax profit margin.It wishes to estimate the additional before-tax profits that the expansion will produce.Using the following information,how much more before-tax cash flow would be realized just in the year 10 alone?

A) less than or equal to $20,000

B) greater than $20,000 but less than or equal to $25,000

C) greater than $25,000 but less than or equal to $30,000

D) greater than 30,000

Correct Answer:

Verified

Q83: Table 4.4

Mr. Lee is considering a

Q86: Table 4.2

High Tech, Inc. is producing

Q89: Table 4.3

The North Bend Manufacturing Company

Q90: A company's production facility,consisting of two identical

Q93: Up,Up & Away is a producer of

Q94: Table 4.3

The North Bend Manufacturing Company

Q95: Table 4.3

The North Bend Manufacturing Company

Q96: Table 4.2

High Tech, Inc. is producing

Q96: John Owen owns a drugstore that is

Q100: Table 4.1

The Union Manufacturing Company is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents