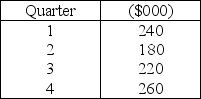

John Owen owns a drugstore that is experiencing significant growth.Owen is trying to decide whether to expand its capacity,which currently is $200,000 in sales per quarter.Sales are seasonal.Forecasts of capacity requirements,expressed in sales per quarter for the next year,follow.  Owen is considering expanding capacity to the $250,000 level in sales per quarter.The before-tax profit margin from additional sales is 15 percent.How much would before-tax profits increase next year because of this expansion?

Owen is considering expanding capacity to the $250,000 level in sales per quarter.The before-tax profit margin from additional sales is 15 percent.How much would before-tax profits increase next year because of this expansion?

A) less than $15,000

B) more than $15,000 but less than $16,000

C) more than $16,000 but less than $17,000

D) more than $17,000

Correct Answer:

Verified

Q23: The lock box department at Bank 21

Q81: Table 4.2

High Tech, Inc. is producing

Q86: Table 4.2

High Tech, Inc. is producing

Q91: Sleep Tight Motel has the opportunity to

Q93: Up,Up & Away is a producer of

Q94: Table 4.3

The North Bend Manufacturing Company

Q95: Table 4.3

The North Bend Manufacturing Company

Q98: Musk L.Flexor owns a hot tub store

Q99: Innovative Inc.is experiencing a boom for the

Q104: Table 4.4

Mr. Lee is considering a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents