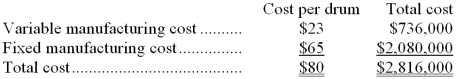

Rowena Corporation manufactures laser printers. Rowena currently manufactures the 32,000 imaging drums that it uses in its printers. The annual costs to manufacture these 32,000 drums are as follows:  Hardware Solutions, Inc. has offered to provide Rowena with all of its imaging drum needs for $72 per drum. If Rowena accepts this offer, 70% of the fixed manufacturing cost above could be totally eliminated. Also, Rowena will be able to use the freed up space to generate $240,000 of income each year in the production of alternative products.

Hardware Solutions, Inc. has offered to provide Rowena with all of its imaging drum needs for $72 per drum. If Rowena accepts this offer, 70% of the fixed manufacturing cost above could be totally eliminated. Also, Rowena will be able to use the freed up space to generate $240,000 of income each year in the production of alternative products.

-Assume that demand for Rowena printers goes up from 32,000 annually to 40,000 annually. Also assume that Rowena has the idle capacity to produce the extra 8,000 drums needed for the printers. Under these conditions, would Rowena be better off to make the drums or buy the drums and by how much? (Assume that there is no change in cost structure.)

A) $96,000 better to buy

B) $160,000 better to buy

C) $204,000 better to make

D) $264,000 better to make

Correct Answer:

Verified

Q66: Two alternatives, code-named X and Y, are

Q67: The Tolar Company has 400 obsolete desk

Q68: The management of Zorrilla Corporation is considering

Q69: Mccubbin Corporation is considering two alternatives: A

Q70: The Tolar Company has 400 obsolete desk

Q72: The management of Dorl Corporation has been

Q73: Two alternatives, code-named X and Y, are

Q75: Kava Inc. manufactures industrial components. One of

Q76: Kleffman Corporation is presently making part X31

Q115: The Tolar Corporation has 400 obsolete desk

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents