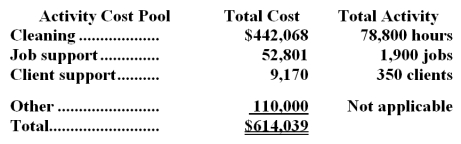

Andracki Housecleaning provides housecleaning services to its clients.The company uses an activity-based costing system for its overhead costs.The company has provided the following data from its activity-based costing system.  The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs.

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs.

One particular client,the Lason family,requested 46 jobs during the year that required a total of 92 hours of housecleaning.For this service,the client was charged $2,230.

Required:

a.Compute the activity rates (i.e. ,cost per unit of activity) for the activity cost pools.Round off all calculations to the nearest whole cent.

b.Using the activity-based costing system,compute the customer margin for the Lason family.Round off all calculations to the nearest whole cent.

c.Assume the company decides instead to use a traditional costing system in which ALL costs are allocated to customers on the basis of cleaning hours.Compute the margin for the Lason family.Round off all calculations to the nearest whole cent.

Correct Answer:

Verified

Q43: Accola Company uses activity-based costing. The

Q44: The following data have been provided by

Q49: Accola Company uses activity-based costing. The

Q51: Fordham Florist specializes in large floral bouquets

Q63: Finkel & Robbins PLC,a consulting firm,uses an

Q64: Data concerning three of Hatt Corporation's activity

Q65: Sailer Corporation uses the following activity rates

Q66: Darter Company manufactures two products,Product F and

Q67: Proudfoot Corporation uses the following activity rates

Q70: Toma Nuptial Bakery makes very elaborate wedding

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents