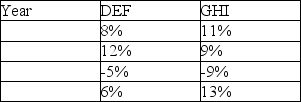

The returns on the stock of DEF and GHI companies over a 4 year period are shown below:

From this limited data you should conclude that returns on

A) DEF and GHI are negatively correlated.

B) DEF and GHI are somewhat positively correlated.

C) DEF and GHI are perfectly positively correlated.

D) DEF and GHI are uncorrelated.

Correct Answer:

Verified

Q24: The index used to represent market returns

Q25: In the real world, most of the

Q27: A negative beta means that on average

Q28: The betas of most stocks are constant

Q29: Which one of the following will provide

Q33: American investors have several alternatives available to

Q35: Explain the relationship between correlation, diversification, and

Q35: Returns on the stock of First Boston

Q36: A beta of 0.5 means that a

Q37: The transaction costs of investing directly in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents