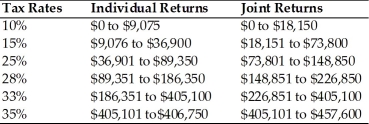

Table 1.2

Use the following tax rates and income brackets for 2015 to answer the following question(s) .

-For a taxpayer in the 25% marginal tax bracket, a long-term capital gain realized in 2015 will be taxed at

A) 5%.

B) 10%.

C) 15%.

D) 25%.

Correct Answer:

Verified

Q21: Bond prices rise as interest rates decline.

Q39: If the value of a common stock

Q41: Table 1.2

Use the following tax rates and

Q43: Table 1.2

Use the following tax rates and

Q46: A well-conceived investment policy statement will specify

A)the

Q47: Sarah purchased a stock one year ago

Q50: In selecting investments consistent with your goals,

Q52: Retirement plans, such as a 401(k), allow

Q55: Tax planning

A) guides investment activities to maximize

Q57: Beginning investors with small amounts to invest

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents