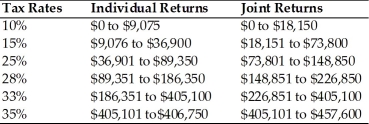

Table 1.2

Use the following tax rates and income brackets for 2015 to answer the following question(s) .

-Michelle and Patrick are in the 28% marginal tax bracket.They bought 100 shares of DJN stock at $45 per share and sold them 4 years later in 2015 at $22 per share? By how much did their loss reduce their taxes in the year when they sold the stock?

A) $0

B) $644

C) $345

D) $1,260

Correct Answer:

Verified

Q47: Investors seeking to increase their wealth as

Q50: In selecting investments consistent with your goals,

Q51: Table 1.2

Use the following tax rates and

Q54: To qualify for long-term capital gains rates,

Q56: Which of the following represent investment goals?

I.

Q56: Speculative and growth oriented investments are least

Q57: Research indicates that investors who closely monitor

Q58: Both the holding period to qualify and

Q59: You should spend money on housing, clothing

Q62: Discuss the relationship between stock prices and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents