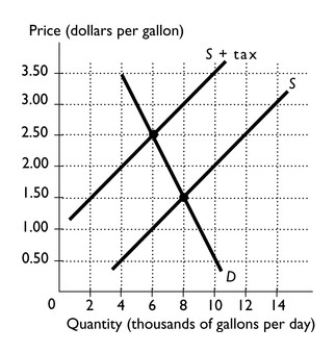

-The figure above shows the market for gasoline.The government has imposed a tax on gasoline.

a.What is the amount of the tax per gallon of gasoline?

b.How much tax revenue will government collect from this tax?

c.How much of the tax is paid by buyers? How much is paid by sellers? Which is more elastic,the supply or demand for gasoline?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q247: Q248: Is the deadweight loss from a sales Q250: Describe the effects of an increase in Q252: What is the difference in the tax Q253: Why are sales taxes,which require that everyone Q254: Suppose the government decides to tax salt.The Q256: "In the United States,more tax revenue is Q361: Which would be a better source of Q376: Suppose the demand for saline solution is Q390: In the Village of Punjab, Sheryl owns![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents