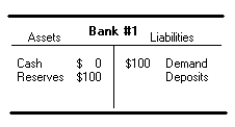

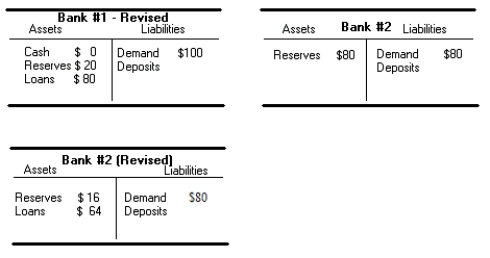

Assume that a banking system starts from scratch with the following characteristics. The first bank has $100 in cash deposits which automatically count as reserves. The banking system has a required reserve ratio of 20% and all banks must lend out their excess reserves. Additionally, a check must be drawn in the full amount of the loan and deposited with another bank. Draw the modified balance sheet for Bank #1 and the balance sheet of the second bank in the process and show what happens to loan creation, reserves and demand deposits. Explain what should happen to the second bank. Below is the balance sheet for Bank #1:

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q40: What are the assets of commercial banks

Q41: Assume there is an economy with a

Q42: Explain each of the following accounting concepts:

Q43: Explain how the existence of currency and

Q44: Explain what is meant by the money

Q46: Suppose that a significant number of U.S.

Q47: Assume that banks become more conservative and

Q48: What are the opportunity costs of holding

Q49: If the required reserve ratio is 20%

Q50: Discuss what role banks play in the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents