Refer to the information provided in Scenario 10.1 below to answer the questions that follow.

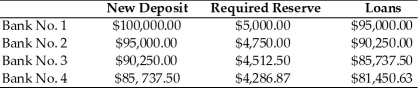

SCENARIO 10.1: The following table shows the changes in deposits, reserves, and loans of 4 banks as a result of a $100,000 initial deposit in Bank No. 1. Assume all banks are loaned up.

-Refer to Scenario 10.1. If the required reserve ratio were changed to 10%, total loans of Bank No. 2 will change to

A) 77,400.

B) 81,000.

C) 85,000.

D) 90,000.

Correct Answer:

Verified

Q152: Assume that banks become more conservative in

Q153: The Federal Reserve System

A) controls the Treasury

Q154: Cold Creek Credit Union has liabilities of

Q155: _ in a bank is considered a

Q156: Futura Bank has liabilities of $8 million

Q158: As commercial banks keep more excess reserves,

Q159: Refer to the information provided in Scenario

Q160: Refer to the information provided in Table

Q161: Bank of Mt. Etna has $500 million

Q162: Crescent City Bank is currently loaned up.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents