On 1 July20X0, Abel Ltd entered into a 50:50 joint operation with Tasman Ltd to develop an oil field off the south coast of Tasmania. Each operator's initial contribution was $2 million. Abel contributed $1 million cash and equipment with a fair value of $1 million and a book value of $500 000. Tasman's contributed $2 million cash.

Additional information

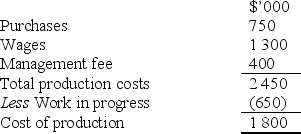

Production costs for the JO for the year ended 30 June 20X1 were:

The remaining useful life of the equipment contributed by Abel is 5 years.

Tasman is responsible for the day to day management of JO and has recognised the management fee received during the year as revenue. The costs of providing these management services to JO was $225 000.

Tasman has sold all of the oil distributed to it and Abel has sold 50% of the oil distributed to it by 30 June 20X1.

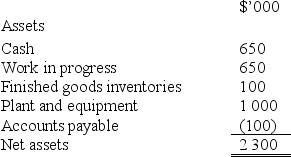

An extract of JO's balance sheet at 30 June 20X1 shows:

Which of the following will not form part of Abel Ltd's initial contribution entry?

A) Debit against the cash in JO account of $1 500 000.

B) Debit against the equipment in JO account of $500 000.

C) Credit against the cash of $1 000 000.

D) Credit against the gain on equipment of $250 000.

Correct Answer:

Verified

Q5: Which of the following statements is not

Q8: Three joint operators are involved in a

Q16: Company A Limited and Company B Limited

Q18: Which of the following statements is not

Q20: A joint operation holds equipment with a

Q21: On 1 July 20X0, the Ears &

Q23: On 1 July 20X0, Abel Ltd entered

Q24: When a joint operator is accounting for

Q25: When eliminating any unrealised profit arising when

Q26: On 1 July 20X0, Abel Ltd entered

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents