During the year ended 30 June 2017, a subsidiary entity sold inventories to a parent entity for $30 000. The inventories had previously cost the subsidiary entity $24 000. By 30 June 2017 the parent entity had sold all the inventories to a party outside the group. The company tax rate is 30%. The adjustment entry in the consolidation worksheet at 30 June 2018 is:

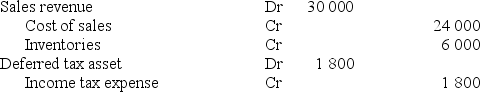

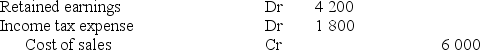

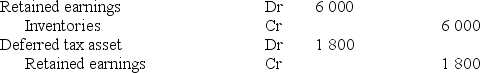

A)

B)

C) No entry is required

D)

Correct Answer:

Verified

Q2: The adjustments included in the consolidation worksheet

Q3: In May 2017, a parent entity sold

Q4: During the current period, a subsidiary entity

Q5: During the year ended 30 June 2017,

Q6: Which of the following statements is incorrect:

A)

Q8: The tax effect of eliminating the unrealised

Q9: Which of the following statements is incorrect:

A)

Q10: During the current period, a subsidiary entity

Q11: Which of the following questions is not

Q12: AASB 10 Consolidated Financial Statements, requires that

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents