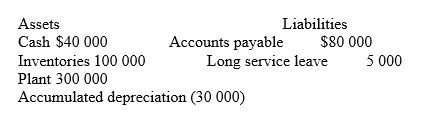

A company commenced business on 1 July 2012. On 30 June 2013, an extract of the statement of financial position prepared for internal purposes, but excluding the effect of income tax, disclosed the following information:

Additional information:

The plant was acquired on 1 July 2012. Depreciation for accounting purposes was 10% (straight-line method) , while 15% (straight-line) was used for tax purposes.

The tax rate is 30%.

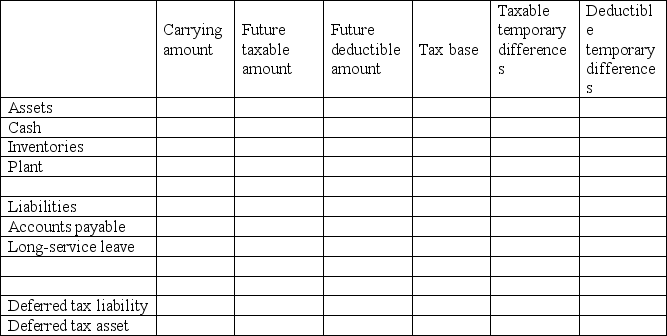

Using the following worksheet, determine the deferred tax asset and deferred tax liability.

The deferred tax liability is:

A) $1500.

B) $4500.

C) $15 000.

D) $34 500.

Correct Answer:

Verified

Q1: A taxable temporary difference is expected to

Q5: Current tax consequences of business operations give

Q7: A deductible temporary difference is expected to

Q9: A company commenced business on 1 July

Q9: Under AASB 112 Incomes Taxes, deferred tax

Q10: Malarky Limited accrued $30 000 for employees'

Q13: On 1 April 2013, the company rate

Q18: Which of the following disclosures are optional

Q19: The following information was extracted from the

Q20: Balchin Limited had the following deferred tax

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents