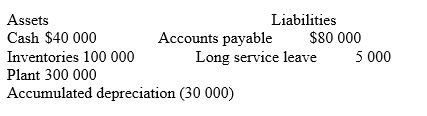

A company commenced business on 1 July 2012. On 30 June 2013, an extract of the statement of financial position prepared for internal purposes, but excluding the effect of income tax, disclosed the following information:

Additional information:

The plant was acquired on 1 July 2012. Depreciation for accounting purposes was 10% (straight-line method) , while 15% (straight-line) was used for tax purposes.

The tax rate is 30%.

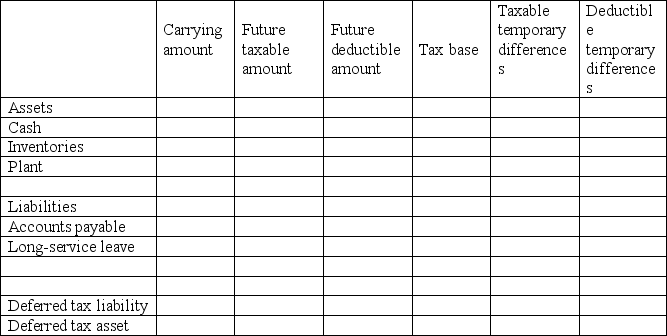

Using the following worksheet, determine the deferred tax asset and deferred tax liability.

The deferred tax asset is:

A) $1500.

B) $4500.

C) $5000.

D) $25 500.

Correct Answer:

Verified

Q1: A taxable temporary difference is expected to

Q3: Differences between the carrying amounts of an

Q6: Generally,when considering the differences between the accounting

Q10: The following information relates to Godfrey Limited

Q10: Malarky Limited accrued $30 000 for employees'

Q12: Deferred tax accounting adjustments are recorded at

Q13: On 1 April 2013, the company rate

Q14: A company commenced business on 1 July

Q20: Balchin Limited had the following deferred tax

Q28: The tax effect method of accounting for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents