Adam Limited and Davies Limited enter into a finance lease agreement with the following terms:

- lease term is 3 years

- estimated economic life of the leased asset is 6 years

- 3 × annual rental payments of $23 000 each payment is one year in arrears

- residual value at the end of the lease term is not guaranteed by the lessee

- interest rate implicit in the lease is 7%.

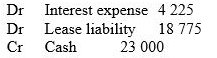

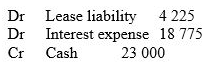

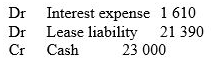

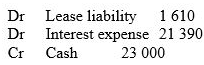

The journal entry recorded by the lessee when the payment is made at the end of the first year is:

A)

B)

C)

D)

Correct Answer:

Verified

Q1: A lessee when accounting for a lease

Q6: On 30 June 2013, Mala Ltd leased

Q9: Nelson Ltd manufactures specialised machinery for both

Q10: Burgess Limited accepts a lease incentive to

Q12: A finance lease is an agreement between

Q13: Which of the following is included within

Q18: The minimum lease payment is defined as

Q18: In relation to finance leases,the following information

Q18: According to AASB 117 Leases, because lease

Q19: AASB 117 deems cancellable leases with which

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents