Ginza Enterprises,a Subsidiary of Universal Enterprises Based in Dallas,reported the Following

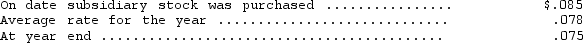

Ginza Enterprises,a subsidiary of Universal Enterprises based in Dallas,reported the following information at the end of its first year of operations (all in yen) : assets--110,000,000;expenses--41,000,000;liabilities--97,500,000;capital stock--5,500,000;revenues--48,000,000.Relevant exchange rates are as follows:  As a result of the translation process,what amount is recorded on the financial statements as the translation adjustment?

As a result of the translation process,what amount is recorded on the financial statements as the translation adjustment?

A) $21,000 debit adjustment

B) $76,000 debit adjustment

C) $21,000 credit adjustment

D) $76,000 credit adjustment

Correct Answer:

Verified

Q10: Which of the following is NOT a

Q11: The primary purpose of the Security and

Q12: The SEC currently requires foreign companies that

Q13: The foreign currency translation adjustments amount is

Q14: Which of the following is NOT a

Q16: Global Trading Company.converts its foreign subsidiary financial

Q17: Hosgood Distributing Inc.converts its foreign subsidiary financial

Q18: Foreign currency translation adjustments arising from translation

Q19: Which of the following is NOT a

Q20: A translation adjustment resulting from the translation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents