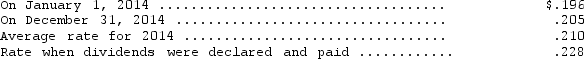

Transit Importing Company.converts its foreign subsidiary financial statements using the translation process.The company's French subsidiary reported the following for 2014: revenues and expenses of 10,500,000 and 6,505,000 francs,respectively,earned or incurred evenly throughout the year,dividends of 500,000 francs were paid during the year.The following exchange rates are available:  Translated net income for 2014 is

Translated net income for 2014 is

A) $910,860

B) $838,950

C) $805,860

D) $733,950

Correct Answer:

Verified

Q1: Which of the following is not correct

Q2: Current generally accepted accounting principles require that

Q3: Complete the following statement by choosing the

Q4: Which of the following is the least

Q6: Which of the following statements most accurately

Q7: Which of the following statements is correct?

A)

Q8: According to FASB ASC Topic 830 (Foreign

Q9: Which of the following is the primary

Q10: Which of the following is NOT a

Q11: The primary purpose of the Security and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents