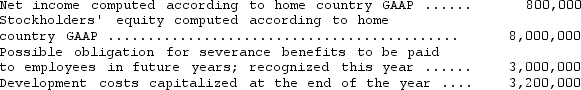

The following financial information is available for Simmer Company,a hypothetical non-U.S.firm with shares listed on a U.S.stock exchange:

If Simmer were following U.S.GAAP,development costs would be expensed when incurred.

If Simmer were following U.S.GAAP,development costs would be expensed when incurred.

According to U.S.GAAP,the possible obligation for severance benefits would not be recognized until it had become probable.

Prepare a reconciliation of Simmer's reported stockholders' equity and net income to the amounts of these items under U.S.GAAP.

Correct Answer:

Verified

Q45: Under international accounting standards,deferred tax assets and

Q46: Which of the following statements is correct?

A)

Q47: The following financial information is for Pasha

Q48: Under international accounting standards regarding depreciation,an entity

A)

Q49: Under international accounting standards,if a sale-leaseback results

Q51: McGovern Corporation,a U.S.company,owns a 100% interest in

Q52: Which of the following is correct regarding

Q53: Which of the following is correct regarding

Q54: Under international accounting standards,remote contingent liabilities are

Q55: Financial information for Pinnacle Enterprises at the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents