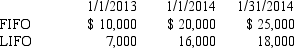

A retailing firm changed from LIFO to FIFO in 2014.Inventory valuations for the two methods appear below:

Purchases in 2013 and 2014 were $60,000 in each year.

Purchases in 2013 and 2014 were $60,000 in each year.

-Using the information above,in the comparative 2013 and 2014 income statements,what amounts would be shown for cost of goods sold? 2013 2014

A) $50,000 $58,000

B) $51,000 $55,000

C) $50,000 $55,000

D) $51,000 $58,000

Correct Answer:

Verified

Q65: Asuncion Company purchased some equipment on January

Q66: Elder Corporation decided to change its depreciation

Q67: For a company with a periodic inventory

Q68: Diamond Company changed from the completed-contract method

Q69: A company mistakenly expensed a $100,000 machine

Q71: In 2014,a company discovered that $20,000 of

Q72: FASB ASC Topic 250 (Presentation-Accounting Changes and

Q73: Witherfork Company was recently acquired by a

Q74: Chiclet Company decides at the beginning of

Q75: Mako's Distributing purchased equipment on January 1,2011.The

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents