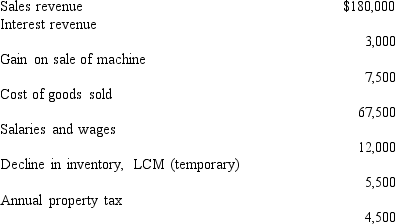

Blind Faith Company reported the following data with regard to its first quarter of operations:  The expected annual income tax rate is 40 percent.Blind Faith should report net income on the first quarter interim financial statements of

The expected annual income tax rate is 40 percent.Blind Faith should report net income on the first quarter interim financial statements of

A) $0.

B) $61,425.

C) $63,225.

D) $65,925.

Correct Answer:

Verified

Q57: Which of the following is the most

Q58: A company that receives 10 percent or

Q59: Disclosure usually is NOT required for

A) contingent

Q60: A truck owned and operated by Mingus

Q61: Interim income tax expense is based on

A)

Q63: Which of the following statements regarding requirements

Q64: The following segments were identified for an

Q65: The sum of reportable segment sales must

Q66: The following segments were identified for an

Q67: How is income tax expense for the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents