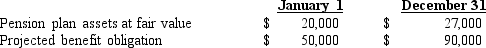

Records for the Bass Corporation's defined-benefit pension plan show a net unrecognized loss at December 31,2013,of $30,000,after recording the pension expense for 2013.The average expected service period of the company's employees is 10 years.The actuary notifies Bass's management that an actuarial gain of $4,000 is determined at January 1,2014.Actual return for 2014 is $2,000,and expected return is $3,000.The following information also is available for the 2014:  The minimum amortization of unrecognized loss increases 2014 pension expense by what amount?

The minimum amortization of unrecognized loss increases 2014 pension expense by what amount?

A) $2,400

B) $1,700

C) $2,100

D) $2,600

Correct Answer:

Verified

Q52: Which of the following represents the best

Q53: Pension-related estimates (not funding data)are provided by

Q54: Unrecognized prior service cost can be amortized

Q55: Which of the following is not a

Q56: One component of net pension expense,unrecognized gains

Q58: Which of the following is not a

Q59: Evasive Corporation pays its employees monthly.The following

Q60: Mint Company sponsors a noncontributory,defined-benefit pension plan.At

Q61: Based on the following data,determine the net

Q62: Feinberg,Inc. ,provides a noncontributory defined benefit plan

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents