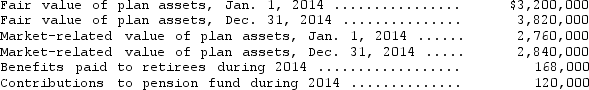

Holster Western Wear,Inc.has a defined benefit pension plan covering its 120 employees.Information relating to the plan follows:

Holster expects a 10 percent return on its pension fund assets.Compute the difference between the actual return and the expected return and explain how this amount affects net periodic pension cost for 2014.

Holster expects a 10 percent return on its pension fund assets.Compute the difference between the actual return and the expected return and explain how this amount affects net periodic pension cost for 2014.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q62: Feinberg,Inc. ,provides a noncontributory defined benefit plan

Q63: The following data relate to the defined

Q64: The amount of the expected return on

Q65: On August 31,2014,payroll data from the records

Q66: The following information relates to the defined

Q68: Interest cost relating to defined-benefit pension plans

Q69: The following balances relate to the defined

Q70: Employees of Mayhem Fabricators,Inc.earned gross wages of

Q71: Using the information below,compute the gain or

Q72: Costs related to a new pension plan

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents