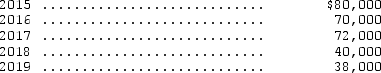

Analysis of the assets and liabilities of Baxter Corp.on December 31,2014,disclosed assets with a tax basis of $1,000,000 and a book basis of $1,300,000.There was no difference in the liability basis.The difference in asset basis arose from temporary differences that would reverse in the following years:  The enacted tax rates are 30 percent for the years 2014-2017 and 35 percent for 2018-2019.The total deferred tax liability on December 31,2014,should be

The enacted tax rates are 30 percent for the years 2014-2017 and 35 percent for 2018-2019.The total deferred tax liability on December 31,2014,should be

A) $105,000.

B) $93,900.

C) $90,000.

D) $69,000.

Correct Answer:

Verified

Q24: A deferred tax liability arising from the

Q25: The following information is taken from Glenville

Q26: The Racing Company had taxable income of

Q27: On the statement of cash flows using

Q28: Longhorn Corporation reported a loss for both

Q30: The following information was taken from Caribbean

Q31: Ballantine Products,Inc. ,reported an excess of warranty

Q32: Historically,the United Kingdom has recognized only those

Q33: If all temporary differences entering into the

Q34: International accounting standards currently are moving toward

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents