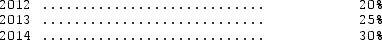

For three consecutive years,2012-2014,Siamese Corporation has reported income before taxes of $200,000 for both financial reporting purposes and tax reporting purposes.During this time,Siamese income tax rates were as follows:  In 2015,Siamese' tax rate changed to 35 percent.Also in 2015,the company reported a loss for both financial reporting and tax reporting purposes of $200,000.Assuming the company uses the carryback provisions,the amount Siamese' should report as an income tax refund receivable in 2015 is

In 2015,Siamese' tax rate changed to 35 percent.Also in 2015,the company reported a loss for both financial reporting and tax reporting purposes of $200,000.Assuming the company uses the carryback provisions,the amount Siamese' should report as an income tax refund receivable in 2015 is

A) $45,000.

B) $50,000.

C) $60,000.

D) $67,500.

Correct Answer:

Verified

Q16: Which of the following is the most

Q17: Recognizing tax benefits in a loss year

Q18: All of the following can result in

Q19: Which of the following arguments is supportive

Q20: Which of the following items results in

Q22: In 2014,The Xavier Company,reported pretax financial income

Q23: The Morris Corporation reported a $59,000 operating

Q24: A deferred tax liability arising from the

Q25: The following information is taken from Glenville

Q26: The Racing Company had taxable income of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents