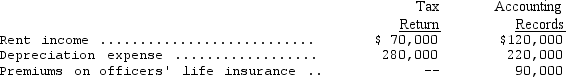

Bodner Corporation's income statement for the year ended December 31,2014,shows pretax income of $1,000,000.The following items are treated differently on the tax return and in the accounting records:  Assume that Bodner's tax rate for 2014 is 30 percent.What is the amount of income tax payable for 2014?

Assume that Bodner's tax rate for 2014 is 30 percent.What is the amount of income tax payable for 2014?

A) $360,000

B) $320,000

C) $294,000

D) $267,000

Correct Answer:

Verified

Q48: During 2014,Epsilon Company had pretax accounting income

Q49: The books of the Speedster Company for

Q50: Intraperiod tax allocation

A) involves the allocation of

Q51: For the current year,Eastern Atlantic Company reported

Q52: Which of the following is an example

Q54: Which of the following is NOT a

Q55: Alpha had taxable income of $1,500 during

Q56: Which of the following represents a permanent

Q57: Rodeo Corporation reported depreciation of $450,000 on

Q58: For the current year,Southern Cross Company reported

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents