Allsgood Appliances computed a pretax financial loss of $60,000 for the first year of its operations ended December 31,2014.Analysis of the tax and book basis of its liabilities disclosed $80,000 in accrued warranty expenses on the books that had not been deductible from taxable income in 2014,but would be deductible in future years when the warranty expenses were paid.

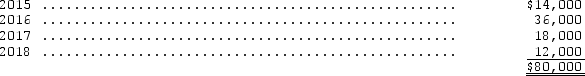

The future warranty payments are expected to occur in the following pattern:

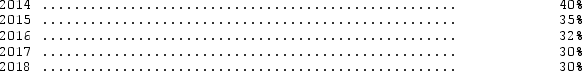

The enacted tax rates for this year and the next four years are as follows:

The enacted tax rates for this year and the next four years are as follows:

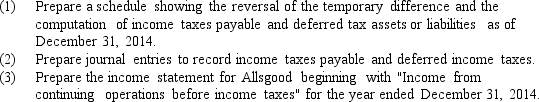

Use the provisions of FASB Statement No.109.

Use the provisions of FASB Statement No.109.

Correct Answer:

Verified

Q58: For the current year,Southern Cross Company reported

Q59: In computing the change in deferred tax

Q60: Which of the following could never be

Q61: Seymour Associates computed a pretax financial income

Q62: Pretax accounting income is $100,000 and the

Q63: Grisoft Inc.computed a pretax financial income of

Q65: Smart Services computed pretax financial income of

Q66: The following differences between financial and taxable

Q67: The data shown below represent the complete

Q68: Oriole Industries computed a pretax financial income

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents