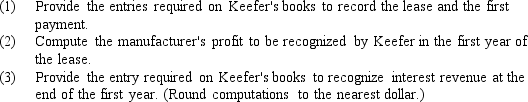

Keefer Inc.uses leases as a means of selling its equipment.On January 1,2014,the company leased a machine to Jeremy Manufacturing Inc.The cost of the machine to Keefer was $78,450.The fair market value (which was the sales price)was $101,184 at the time of the lease.Annual lease payments are $13,500 and are payable in advance for 12 years.At the end of the lease term,title to the machine will pass to Jeremy Manufacturing.

Correct Answer:

Verified

Q61: Current generally accepted accounting principles do not

Q62: Daniels Company entered into a direct-financing lease

Q63: Governor Corporation entered into a direct financing

Q64: Always Distributing entered into a leasing agreement

Q65: Pralow,Inc. ,leased an asset to Bender Corporation.The

Q67: On July 1,2014,Biplane Aviation leased two company

Q68: If the lessee and the lessor use

Q69: Bayou Inc.leases equipment to its customers under

Q70: On January 1,2014,Benjamin Industries leased equipment on

Q71: Ollie Company entered into a lease agreement

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents