On January 1,2014,J.M.Rodriguez,owner of JMR Sound,sold the building the studio currently occupies to Rave Up Events Company for the current market value of the building of $9,000,000.Prior to the sale,the carrying value of the building was $7,000,000.The estimated remaining useful life of the building is 10 years,with no residual value at that time.Straight-line depreciation is used to depreciate the building.

On the same day as the sale,January 1,2014,Rodriguez signed a 10-year noncancelable leaseback agreement that has a 15 percent implicit rate of return for the lessor.The lessee's incremental borrowing rate also is 15 percent.Annual payments begin on January 1,2014.During 2014,Rodriguez will pay $10,000 executory costs if the transaction qualifies as a direct-financing lease.If the agreement qualifies as an operating lease,this $10,000 will be paid by the buyer-lessor.For convenience,provide all amounts in your solution in $000.

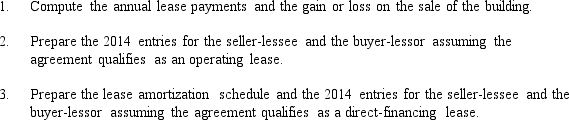

Required:

Correct Answer:

Verified

Q69: Bayou Inc.leases equipment to its customers under

Q70: On January 1,2014,Benjamin Industries leased equipment on

Q71: Ollie Company entered into a lease agreement

Q72: Soundesign Company entered into a lease of

Q73: Jefferson Financing,Inc.purchased a packing machine to lease

Q74: Neils Company leased an asset for use

Q75: NPR leased a special crane to WLRN

Q77: On January 1,2014,Logan Company leased a machine

Q78: Which of the following is true regarding

Q79: Monsieur Retail Stores is negotiating three leases

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents