Jordan,Inc. ,loaned Julius Company $40,000 on January 1,2010.The 8 percent,7-year,simple-interest loan note called for annual interest payments each December 31.The note is due December 31,2023.Julius made the required interest payments through December 31,2013.In early January 2014,Julius began to default on some of its other debts and asked Jordan to renegotiate the original debt agreement,including an extension of the maturity date.Jordan refused but could see that the remaining scheduled payments on the loan were in jeopardy.

Jordan reevaluated the Julius note and estimated that the remaining interest payments would be only three-fourths of the original amount (based on the original principal amount),and that only one-half of the principal amount would be collected.

Jordan uses the interest method to account for interest after recording a note impairment.

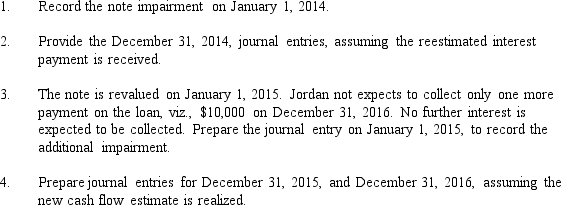

Required:

Correct Answer:

Verified

Q71: On January 1,2014,Farming Associates purchased 25 percent

Q72: At January 1,2014,a company had a net

Q73: Large,global enterprises typically have an equity interest

Q74: Which of the following is true regarding

Q75: The following information is available for an

Q76: On January 1,2014,Palsoe Corp.acquired 30 percent (13,000

Q77: On January 1,2013,a company purchased four 5%,$1,000

Q78: Cronie Enterprises purchased 10,000 shares of stock

Q79: Rider Company had the following portfolio of

Q80: Under the provisions of FASB ASC Topic

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents