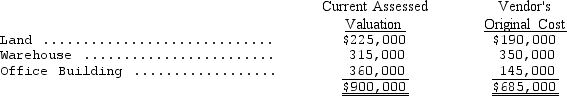

On May 1,2014,Abiuso Corporation purchased for $790,000 a tract of land on which a warehouse and office building were located.The following data were collected concerning the property:

Determine the appropriate amounts that Abiuso should record for the land,warehouse,and office building.

Determine the appropriate amounts that Abiuso should record for the land,warehouse,and office building.

Correct Answer:

Verified

Q60: Acquired in-process research and development should be

A)

Q61: Dan Company recently acquired two items of

Q62: On December 1,2014,Gomer Corporation exchanged 5,000 shares

Q63: Torrent Lumber shows the following balances in

Q64: The cost of a building to be

Q66: One of the most critical steps in

Q67: On January 1,2014,Mercury Airlines contracted with Dover

Q68: Assets constructed for a firm's own use

Q69: The Maker Company exchanged 25,000 shares of

Q70: Which of the following best describes the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents