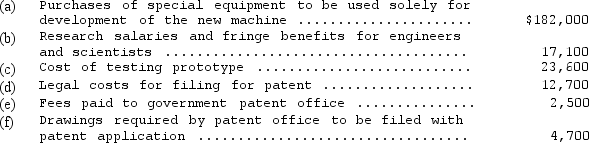

Ericton Enterprises Inc.developed a new machine for manufacturing baseballs.Because the machine is considered very valuable,the company had it patented.The following expenditures were incurred in developing and patenting the machine.

Ericton elected to amortize the patent over its legal life.At the beginning of the second year,Ericton Enterprises paid $24,000 to successfully defend the patent in an infringement suit.At the beginning of the fourth year Ericton determined that the remaining estimated useful life of the patent was five years.

Ericton elected to amortize the patent over its legal life.At the beginning of the second year,Ericton Enterprises paid $24,000 to successfully defend the patent in an infringement suit.At the beginning of the fourth year Ericton determined that the remaining estimated useful life of the patent was five years.

Record the above transactions in general journal form for Ericton Enterprises Inc.for the first five years of the life of the patent.Include any amortization or depreciation for each period.

Correct Answer:

Verified

Q69: The Maker Company exchanged 25,000 shares of

Q70: Which of the following best describes the

Q71: Which of the following is true regarding

Q72: Which of the following best describes the

Q73: Everheat Company is an oil and gas

Q74: On March 1,2014,the Hauk Company paid $400,000

Q75: During 2014,Brent Industries,Inc.constructed a new manufacturing facility

Q76: On February 1,2013,Forwards Corporation purchased a parcel

Q78: Allure Company made the following cash expenditures

Q79: The cost of land to be used

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents