From Inception of Operations to December 31,2013,Centaur Corporation Provided for Uncollectible

From inception of operations to December 31,2013,Centaur Corporation provided for uncollectible accounts receivable under the allowance method: Provisions were made monthly at 2 percent of credit sales;bad debts written off were charged to the allowance account;recoveries of bad debts previously written off were credited to the allowance account;and no year-end adjustments to the allowance account were made.Centaur's usual credit terms are net 30 days.

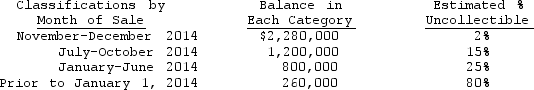

The credit balance in the allowance for doubtful accounts was $260,000 at January 1,2014.During 2014,credit sales totaled $18,000,000,interim provisions for doubtful accounts were made at 2 percent of credit sales,$180,000 of bad debts were written off,and recoveries of accounts previously written off amounted to $30,000.Centaur installed a computer system in November 2014 and an aging of accounts receivable was prepared for the first time as of December 31,2014.A summary of the aging is as follows:

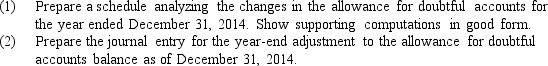

Based on the review of collectibility of the account balances in the "prior to January 1,2014" aging category,additional receivables totaling $120,000 were written off as of December 31,2014.Effective with the year ended December 31,2014,Centaur adopted a new accounting method for estimating the allowance for doubtful accounts at the amount indicated by the year-end aging analysis of accounts receivable.

Based on the review of collectibility of the account balances in the "prior to January 1,2014" aging category,additional receivables totaling $120,000 were written off as of December 31,2014.Effective with the year ended December 31,2014,Centaur adopted a new accounting method for estimating the allowance for doubtful accounts at the amount indicated by the year-end aging analysis of accounts receivable.

Correct Answer:

Verified

Q64: The plan of organization and all the

Q65: The following information was abstracted from the

Q66: Halen Company factored $50,000 of its accounts

Q67: The following information was abstracted from the

Q68: The books of Barry's Service,Inc.disclosed a cash

Q69: The Ryan Manufacturing Company received its bank

Q70: The information below is from the books

Q72: Which of the following is one of

Q73: Which of the following is not correct

Q74: The accountant for the Teffen Company assembled

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents