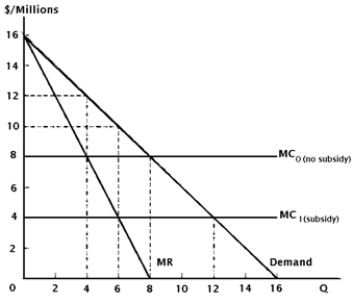

Assume Boeing Inc. (of the United States) and Airbus Industries (of Europe) rival for monopoly profits in the Canadian aircraft market. Suppose the two firms face identical cost and demand conditions, as seen in Figure 6.1.

Figure 6.1. Strategic Trade Policy: Boeing versus Airbus

-Referring to Figure 6.1, assume that Boeing is the first to enter the Canadian market.Without a governmental subsidy, the firm maximizes profits by selling ______________ aircraft at a price of $______________, and realizes profits totaling $______________.

A) 4, $12 million, $16 million

B) 4, $16 million, $12 million

C) 8, $12 million, $16 million

D) 8, $16 million, $12 million

Correct Answer:

Verified

Q33: The Uruguay Round of trade negotiations was

Q34: In U.S.trade law, Section 301, cases involve

Q35: The average tariff rate today on dutiable

Q36: Suppose the United States imposes trade sanctions

Q37: Those who argue in favor of import

Q39: The most recent round of multilateral trade

Q40: Suppose the president lowers tariffs on radios

Q41: In 1995, the General Agreement on Tariffs

Q42: Assume Boeing Inc. (of the United States)

Q43: Figure 6.3 represents the Iraqi computer market.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents