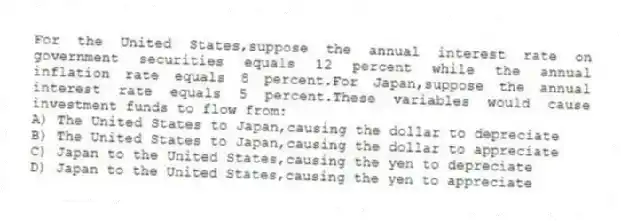

For the United States,suppose the annual interest rate on government securities equals 12 percent while the annual inflation rate equals 8 percent.For Japan,suppose the annual interest rate equals 5 percent.These variables would cause investment funds to flow from:

A) The United States to Japan,causing the dollar to depreciate

B) The United States to Japan,causing the dollar to appreciate

C) Japan to the United States,causing the yen to depreciate

D) Japan to the United States,causing the yen to appreciate

Correct Answer:

Verified

Q5: When the price of foreign currency (i.e.,the

Q6: Given a system of floating exchange rates,weaker

Q7: The high foreign exchange value of the

Q8: For the United States,suppose the annual interest

Q9: If Mexico's labor productivity rises relative to

Q11: In the presence of purchasing-power parity,if one

Q12: High real interest rates in the United

Q13: Assume that the United States faces an

Q14: Given a system of floating exchange rates,stronger

Q15: If wheat costs $4 per bushel in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents