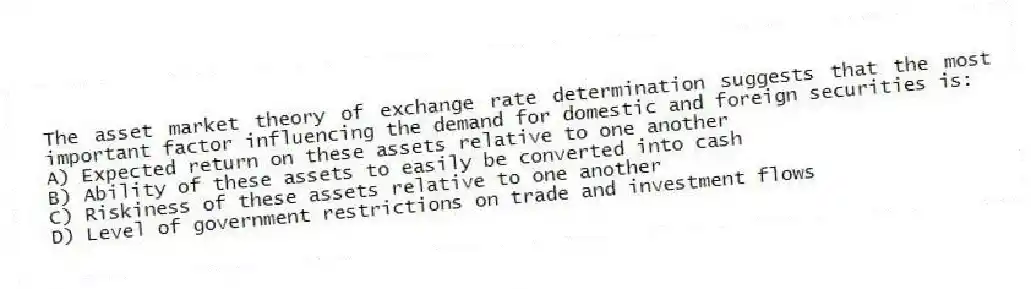

The asset market theory of exchange rate determination suggests that the most important factor influencing the demand for domestic and foreign securities is:

A) Expected return on these assets relative to one another

B) Ability of these assets to easily be converted into cash

C) Riskiness of these assets relative to one another

D) Level of government restrictions on trade and investment flows

Correct Answer:

Verified

Q63: Relatively high interest rates in the United

Q64: When deciding between U.S.and British government securities,an

Q65: Given a floating exchange rate system an

Q66: The purchasing-power parity theory suffers from the

Q67: Suppose the exchange rate between the U.S.dollar

Q69: Figure 12.3Market for British Pounds

Q70: Increased tariffs on U.S.steel imports cause the

Q71: Under a system of floating exchange rates,a

Q72: With floating exchange rates,relatively high productivity growth

Q73: In the long run,exchange rates are primarily

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents