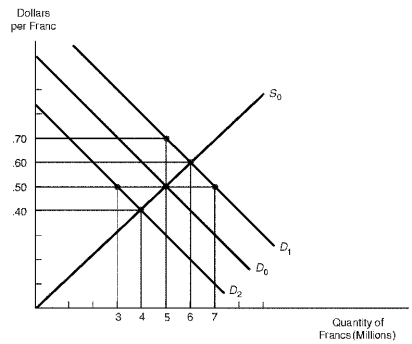

Figure 15.1 shows the market for the Swiss franc. In the figure, the initial demand for marks and supply of marks are depicted by D? and S? respectively.

Figure 15.1. The Market for the Swiss Franc

-Refer to Figure 15.1.Suppose the demand for francs increases from D? to D?.Under a fixed exchange rate system,the U.S.exchange stabilization fund could maintain a fixed exchange rate of $0.50 per franc by:

A) Selling francs for dollars on the foreign exchange market

B) Selling dollars for francs on the foreign exchange market

C) Decreasing U.S. exports, thus decreasing the supply of francs

D) Stimulating U.S. imports, thus increasing the demand for francs

Correct Answer:

Verified

Q44: Table 15.1.

The Market for Francs

Q47: To defend a pegged exchange rate that

Q47: Figure 15.1 shows the market for the

Q48: Table 15.1.

The Market for Francs

Q50: Under managed floating exchange rates,a central bank

Q52: A main purpose of exchange stabilization funds

Q53: Table 15.1.

The Market for Francs

Q54: As a policy instrument,currency devaluation may be

Q55: Given a two-country world,suppose Japan revalues the

Q60: Given a two-country world,assume Canada and Sweden

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents