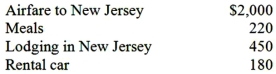

Shelley is employed in Texas and recently attended a two-day business conference in New Jersey.Shelley spent the entire time at the conference and documented her expenditures (described below) .What amount can Shelley deduct as an employee business expense?

A) $2,850

B) $2,740

C) $1,850 if Shelley's AGI is $50,000

D) All of these are deductible if Shelley is reimbursed under an accountable plan.

E) None of the expenses are deductible - only employers can deduct travel expenses.

Correct Answer:

Verified

Q55: Which of the following is a true

Q56: Riley operates a plumbing business and this

Q56: John is a self-employed computer consultant who

Q57: Ed is a self-employed heart surgeon who

Q59: When does the all-events test under the

Q61: Which of the following is a true

Q62: Joe is a self employed electrician who

Q64: Brad operates a storage business on the

Q69: Todd operates a business using the cash

Q98: Which of the following is NOT considered

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents