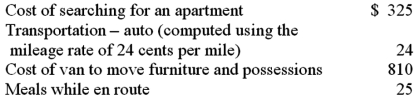

Constance currently commutes 25 miles from her house to her existing part time job in the suburbs.Next week she begins a new full time job in another state,and this job location is 100 miles from her existing home.Because of the additional distance Constance is selling her house,and she has rented an apartment that is only 2 miles from her new job.Constance expects to pay the following moving expenses.  Determine if this move qualifies for a moving expense deduction and calculate the amount (if any) of the deduction.

Determine if this move qualifies for a moving expense deduction and calculate the amount (if any) of the deduction.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q77: Which of the following is a true

Q78: Which of the following is a true

Q79: Which of the following is a true

Q80: Which of the following is a true

Q81: Grace is employed as the manager of

Q81: Which of the following itemized deductions is

Q83: Homer is an executive who is paid

Q84: Frieda is 67 years old and deaf.If

Q85: Which of the following is a true

Q87: Shelby is working as a paralegal while

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents